Step by Step Guide for EC Online Telangana Certificate

An Encumbrance Certificate is one of the required documents used for real estate transactions. This is proof that there is a free title or ownership of the property mentioned. This document is important to check when purchasing a house whether the building is free of legal or financial liability. This certificate ensures that an individual is fully owned of the property. Registration and Stamp Department of Telangana is providing the facility for Telangana people now check their property Encumbrance Certificate (EC) status online.

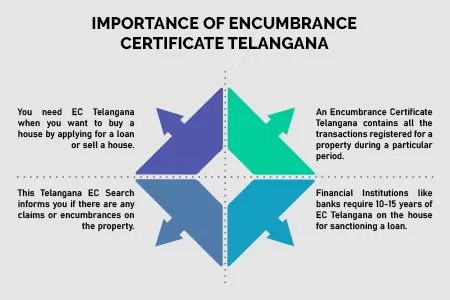

Buying a house is one of the most significant investments in life. When you plan to buy a house, you must take into account the 'Encumbrance Certificate' (EC) . Here, let us know in detail the importance of the Encumbrance Certificate in property transactions and how to get it.

Registration & Stamps Department of Telangana started a new website http://registration.telangana.gov.in/EncumbranceSearch.html. The citizens of Telangana can now search the EC Certificate online by just log on to the official Website of the Registration & Stamp Department of Telangana and check their property registration detail online and Download property EC (Encumbrance Certificate) online. The portal covers all the districts of Telangana.

Importance of Encumbrance Certificate Telangana

The below information helps you to know how to check EC online Telangana.

Subscribe to Receive Latest Real Estate News

Purpose of Encumbrance Certificate

The purpose of the EC is to corroborate the situation of the building, by means of a public document that includes the specific description of the property, in which it is mentioned whether it has or not has a lien. That is, it tells us if the apartment or house has or is not has guaranteeing debt and if there are rights that prevent taking full advantage of the property. This certificate can be presented to any person to authenticate that the property is not subject to any of the limitations described above. So, it is a usual procedure, and in some cases necessary, to do things that have to do with the property to buy/sell it, request a mortgage loan, donate the building, etc.

Check out the price drops in Hyderabad

Apartments in Hyderabad Below 25 Lakhs Plots in Hyderabad below 5 Lakhs Villas in Hyderabad below 80 LakhsWhat is the Procedure to obtain the Encumbrance Certificate (EC)?

- The application should be submitted to the Sub-Registrar’s office, under which the property is registered at Telangana Registration EC.

- At present, EC is issued in the states such as Andhra Pradesh, Telangana, Tamil Nadu, Kerala, Gujarat, Karnataka, Odisha, and Pondicherry.

- In the other states, you must apply to obtain EC using Form 22 manually. Along with the application, you must provide the attested copy of your residential address and the purpose for which the Encumbrance Certificate is required at the Telangana Registration EC Sub-Registrar’s office.

- The additional details to be filled in the application include Survey Number, house/ property address, the period for which Telangana Encumbrance is required, and a full description of the house/ property, Telangana Stamps and Registration.

- You must pay a fee with the application form. The amount of fee varies according to the period of encumbrance. The EC is given in the regional language. You must pay an additional fee if you want the Telangana Encumbrance to be translated.

The officer-in-charge will check the application and process it by checking the entries available in his office. He will issue a TS EC (Form 15 or Form 16) within 15-30 days of the date of receiving the application.

Step by Step Procedure for Online Encumbrance Certificate

Below the given steps helps you to apply for Encumbrance Certificate Telangana.

The applicant has to visit the official website of the Meeseva portal.

You will land on the homepage of the portal then click on the Government Forms.

Click on Meeseva services from the displayed list of services.

You can view the list of departments from that you can register for Encumbrance Certificate Telangana.

After that, you can download the EC from the portal.

Fill the application form with the necessary details which include the name of the owner of the property, the Sale / Purchase deed of the property, etc. The application form should be filled with the right details and attach the correct documents.

Submit your correctly filled application form at the nearest Meeseva center of your area and pay the specified fee.

After the submission, the applicant will be provided with an acknowledgment slip for further reference.

Later, the concerned officer will check your submitted documents and verifies, the application will be forwarded to the Sub Registrar Office.

After verification, the concerned officer will forward the status to the Meeseva center and your mobile through SMS.

What are Form 15 and Form 16?

- Form 16 shows nil encumbrances and is issued if the property does not have any property dues during the given period.

- Form No. 15 will be issued, if the property has encumbrance such as gift, partition, lease, and mortgage, the parties involved, the registered number of the document, Telangana Stamps and Registration, and other details in a date-wise manner.

- If you ask for an Encumbrance Certificate Telangana for a particular period, you will get the details only for that period and not more.

- The details will be given from the entries available in the register available with the sub-registrar.

To know the complete proof of ownership of the house, the buyer must obtain the possession certificate in addition to the EC Telangana.

The Encumbrance Certificate Telangana is an important document used for buying property or land in India and Telangana Stamps and Registration. It is evidence of ownership title. To transfer the property, EC is required compulsory.

To apply for a loan for the purchase of property in any bank or financial institution, you have to furnish the Encumbrance Certificate Telangana to confirm the property is free from any other debts. It is an important Certificate to get changes to the property done.

This certificate must be provided to the related Village or Panchayat Officer in your area to update the land tax records. EC Telangana is an important document that helps to withdraw the Provident Fund (PF) for a property purchase or house construction.

Key Points of Encumbrance Certificate

An Encumbrance Certificate Telangana records the below property-related details.

What are the Charges to be paid to get an Encumbrance Certificate?

- The charges to be paid to get the TS EC (Telangana Encumbrance Certificate) are given below.

- The service charges to be provided by the applicant are Rs 25 , and the applicant must also pay legal fees. These payments vary as per the age of the applicant.

- The age of the applicant is below 30 years , then he/she has to remit charges are Rs 200 .

- The age of the applicant is 30 or above 30 years , then he/she has to pay Rs 500 .

Where do I get the Encumbrance Certificate?

The Telangana Encumbrance Certificate is a legal document that records the situation in which specific property is located, according to the inscriptions and documents existing in the archives of the Public Registry of Property. This document contains the description of a property to certify that it has no lien, bond, mortgage, or seizure.

It can be requested when it is necessary to prove the situation in which your property is located in the Public Registry of Property where your deed has been registered. Any legal person can request your EC Telangana. It will be valid for a specific time and takes approximately six business days.

To obtain your certificate, you must go to the corresponding registry office, fill out the application with the registration details of the property and cover the respective rights of each property depending on the office. You have to check the Telangana Stamps and Registration.

What is the Procedure to Get EC offline?

- You need to apply Form No. 22 to receive the EC application.

- On the application, you have to affix a Rs 2 non-judicial stamp.

- The complete residential address and the reason for which the certificate is required must be given.

- The survey number and the location where the property is located must be given. The timeframe, complete description of the land, measurements, and property boundaries are also important to mention. (Your lender can need an EC statement for 10 to 15 years if you are applying for a home loan.)

- Include copies of your proof of ID and proof of residential address.

- Provide the forms to the officer concerned at the Sub-Registrar Office (SRO).

- You need to pay the fees required. The EC fee is dependent on the number of years you would like to obtain the EC. Kindly remember that it is often known that a fraction of a year is a full year. (EC shall be issued from the start of the financial year, i.e., from 1 April).

- The fee can vary depending on the state. It's very nominal. The 'search charge' may be in the range of Rs 15 to Rs 50 for the first year and there may be payments in the range of Rs 5 to Rs 10 for each additional year (approx.).

- With exception of a few states, in India, encumbrance certificates are often physically issued. Andhra Pradesh, Odisha, Kerala, Puducherry, Tamil Nadu, and Telangana are states which issue encumbrance certificates online.

- The time it takes to receive the EC statement is around 10 to 30 days.

Benefits of Encumbrance Certificate

- Every home buyer must have an Encumbrance certificate as the banks are likely to deny home loans against property in Hyderabad or other states that won’t have an EC Telangana.

- You can prove a title hold on your property in the future, and no one can showcase your right on the property.

- Disbursal of a home loan becomes easier after showing an Encumbrance Certificate as it proves that the property you are buying is debt-free.

Difference between Encumbrance Certificate and Occupancy Certificate

An occupancy certificate is one that makes you eligible for various civic amenities include sewer, water pipeline, electricity, and more. But it will not declare the particular property is debt-free. So, you must get an Encumbrance Certificate from the seller to get an official acknowledgment that the particular property you are buying is debt-free.

By introducing the online platform for Encumbrance Certificate (EC), the Government of Telangana has made the property transaction citizen-centric. A great initiative indeed!

Visit Leading online real estate portal to know about trending Apartments/Flats sale in Hyderabad. we guide you with accurate property information such as project construction photos, latest offers, available units, facings, builder info for a better understanding of the project. Our 100% verified property information helps you in decision making.

Disclaimer: The information provided above is for informational purposes only. https://propertyadviser.in does not guarantee the accuracy, completeness, or reliability of the information and shall not be held responsible for any action taken based on the published information.