Stamp Duty And Property Registration Charges In AP

The property registration is mandatory in India as per the Indian Registration Act, 1908. The Transfer of property is to be registered to obtain the rights of the property on the execution date of the deed. The stamp duty and registration charges are the taxes a property buyer must pay to the respective authorities to register a property in their name. Here, Property Adviser provides the procedure for property transfer and the stamp duty and registration charges in Andhra Pradesh and how is it calculated.

The government of Andhra Pradesh has revised the stamp duty on the registration of property effective from 11th August 2020. In order to amend the market value, the AP government has formed committees under a joint collector for each district. The categories were divided on the basis of a municipal corporation/municipality, major gram panchayat, small gram panchayat. The market value for agricultural land is calculated in acres and residential properties in square yards.

According to the amendment, the stamp duty is 5%, the registration fee is 1%, the transfer fee is 1.5% of the market value of property. On the issuance of gifts to family members, stamp duty is 2%, registration charges are 0.5% (subject to minimum of Rs 1000 to maximum Rs 10000 fee), and the transfer charge of 1.5% is imposed. For the registration of family settlement, 2% stamp duty and registration fee of Rs. 1000 can be paid. There is no transfer fee in respect of this category.

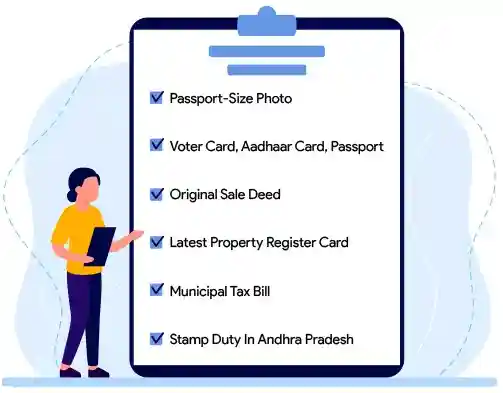

What are the Documents required for property registration in Andhra Pradesh?

Below are the documents required for the property registration in Andhra Pradesh

* The stamp duty is the percentage of the transaction value levied by the state government, on every registered sale.

Subscribe to Receive Latest Real Estate News

Property registration charges in AP

The state government fixes stamp duty. For example, in Andhra Pradesh, the base Andhra Pradesh stamp duty rate of apartment/ flat is 5%, transfer duty is 1.5%, and the registration fee is 0.5 %. Stamp duty fee is imposed on the absolute estimation of the property.

To know further details on ap land registration charges and stamp duty, go through the Andhra Pradesh state government official website. http://registration.ap.gov.in/

| Type of fee | Registration rates | Stamp duty rates | Transfer duty charges |

|---|---|---|---|

| Sale deed | 1% | 5% | 1.5% |

| Gift (gift within the family) | 0.5% | 2% | 1.50% |

| Exchange | 0.5% | 5% | 1.5% |

| Partition | Rs. 1000 | 2% | Nil |

| Release | 0.5% (Min Rs. 1,000 to Max Rs. 10,000) | 3% | Nil |

| Agreement of sale cum general power of attorney | Nil | Nil | Nil |

For more details on registration charges and stamp duty in Andhra Pradesh, refer the official website of the State government - http://registration.ap.gov.in/CitizenServices/ACT/Registration/RegistrationFees.pdf

Check out the price drops in Hyderabad

Apartments in Hyderabad Below 25 Lakhs Plots in Hyderabad below 5 Lakhs Villas in Hyderabad below 80 LakhsThe stamps and registration charges in AP are calculated using the formula given below:

- Where property value is (higher of ready reckoner rate or actual transaction value)

- Ready Reckoner Rate (RRR)/circle rate means, it is the minimum value of the property that is fixed by the state government. And stamp duty is calculated as the higher of ready reckoner rate or actual transaction value.

- Many property transactions in India take place by the market rate in a particular locality. The stamp duty and registration fees are paid by the buyer are calculated from the market rate. In rare cases, where the RRR is higher, the stamps and registration fees in Andhra Pradesh will be calculated on the RR Rate.

Example to calculate the stamp duty and registration charges in Andhra Pradesh

Assume, the property value in a particular area has RRR (Ready Reckoner Rate) of Rs.5000 per Sq. Ft. However, if the market price of the property is Rs. 6000 per Sq. Ft, the buyer has to pay stamp duty and AP land registration charges on Rs.6000 per Sq.Ft, as it is higher.

Let you know in brief about the charges with the below example.

If the Ready Reckoner Rate is Rs. 70,00,000 and the actual transaction value is Rs. 80,00,000 then stamp duty @5% is calculated as:

- Stamp duty = 5% of (higher of Ready Reckoner Rate or actual transaction value) (i.e.) 5% of (higher of Rs 70 lakhs or Rs 80 lakhs)

80,00,000*5/100 = 4,00,000 - Registration charge = 1% of (higher of Ready Reckoner Rate or actual transaction value) (i.e.) 1% of (higher of Rs 70 lakhs or Rs 80 lakhs)

80,00,000*1.0/100 = 80,000 - Transfer duty =1.5% of (higher of ready reckoner rate or actual transaction value) (i.e.) 1.5% of (higher of Rs 70 lakhs or Rs 80 lakhs)

80,00,000*1.5/100 = 1, 20,000

Therefore, the amount of the stamps and registration charges in Andhra Pradesh is 6,00,000

- Stamp duty = Rs. 4,00,000

- Registration charge = Rs. 80,000

- Transfer duty = Rs. 1,20,000

- Total registration cost = 4,00,000+80,000+1,20,000 = Rs. 6,00,000

What is stamp duty and who collects it?

Did you know

Stamp duty in India was first introduced by the British in 1899. Back then, the stamp duty had had to be deposited in the government treasury for all property transaction, which were carried out through documents or instruments under the provisions subscribed in the Indian Stamp Act of 1899 and Andhra Pradesh Stamp Act of 1986.

Stamp duty is a tax collected by the local authority during the transfer of property from one person to another.

- The state government collects the amount and is governed under the Indian stamp act 1922.

- The state government collects stamp duty, and it varies from one state to another.

- The payment of stamp duty includes stamp duty, transfer duty fee, and AP land registration charges. it is calculated on the market value of the property.

What are the benefits of property registration?

- The registration of the property at the respective authority helps for proper recording of documents which provide more authenticity and ownership.

- To ensure the prevention of fraud, conservation of evidence, the transfer of title to the owner.

- By registering a property, the document will maintain an up-to-date public record.

Explain the stamp duty payment process.

- If you buy a property, then registration of the new property is mandatory. also, you have to pay stamps and registration charges in AP.

- With the AP registration and payment of fees, you will become the owner of your property legally. this document helps in any future unexpected property disputes.

- You will also have a duplicate copy of your sale or transfer deed in sub-registrar’s office. it will help in the case if you lose your original documents.

What are the types of property deeds or transactions where stamp duty and registration charges are applicable?

How are the stamp duty charges calculated

The calculation of the stamp duty charges differs based on below features:

Property Location

A property located in an urban area attracts more stamp duty compared to rural areas.

Property Type

Lower stamp duty is charged for a residential property

(flat/apartment) compared to a commercial property (industries/ commercial complex/ hotels).

Age of the Property

A new property has more stamp duty than older/resale properties.

Gender of Buyers

A female buyer can get a rebate on the stamp duty charges.

Age of Buyer

A senior citizen can also get a rebate on the stamp duty charges.

Apart from an offline method of property registration, one can also opt for the digital mode by visiting the official website http://registration.ap.gov.in/ of the Andhra Pradesh government. The online system of property registration is not only an easier way out but also saves time and energy.

Visit Leading online real estate portal to know about trending Apartments/Flats sale in Hyderabad. we guide you with accurate property information such as project construction photos, latest offers, available units, facings, builder info for a better understanding of the project. Our 100% verified property information helps you in decision making.

Disclaimer: The views expressed above are for informational purposes only based on industry reports and related news stories. https://propertyadviser.in does not guarantee the accuracy, completeness, or reliability of the information and shall not be held responsible for any action taken based on the published information.