Buying a house is indeed a big deal. We all have a lot of dreams attached to that one address we aim and wish to own for our family. However, buying a house also involves a lot of factors that need to be taken into consideration every time and we tend to miss out a lot of details that should otherwise be maintained and taken care while buying a house. One of those details is credit score.

Do you know how credit score can actually impact a great deal in your home buying decision? There are certain questions that come to our mind regarding a good credit score or the minimum credit score for home loans that should be maintained. So, let’s uncover more details that help you to understand the importance of credit score while buying a house for you and your family.

If your credit score is good, then it is actually going to help you a lot while availing the home loan. In fact, your interest rate is also decided on that account.

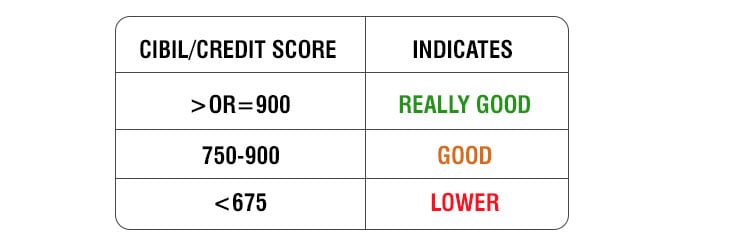

Below is the table to help you to evaluate and assess your ideal credit score that’s required while applying for home loans with the bank.

Benefits of higher credit score

Benefits of higher credit score

- More attractive home loan offers

- Lower rate of interest

- Higher loan amounts

- Longer repayment periods

- A good credit score also acts as an essential evidence in your favour to assure financial institutions of your credibility and integrity when it comes to the repayment of loans

The key aspects that you need to keep in mind in order to improve your credit score

Now that you have understood the good credit score and also importance of credit score when buying a house, you might not be aware of the key aspects that can be checked out and kept in mind in order to improve your credit score. Here are the steps listed below that will guide you in the right direction and perk up your credit score as well just in case its lower than 675.

-

Keep an eye on your credit report with your bank

Sometimes certain situations happen especially on our professional or financial front that we might fail to maintain the desirable credit score but the outcome of the same can be bad for your credit health. If you feel that there might be some potential mistakes that you missed out on, there’s no need to panic. You can still try improving your credit worthiness by keeping an eye on your credit report. Request for the same and evaluate it and fix the inaccuracies or make sure to start paying your bills timely, essentially 5-6 months before you have to apply for the home loan.

-

Avoid applying for new loans

Focus on clearing your pending bills first before applying for any other loan if you also have to apply for a home loan soon. It might affect your credibility and even trap you in legal implications that might completely sabotage your intentions to apply for that home loan. Hence, don’t get involved in the loan cycle and maintain your credibility.

-

Smart planning in advance goes a long way

As stated, there’s nothing to worry if your score is or has been low due to some inevitable reasons. Just keep a track on your progress, plan out everything and start making timely payments at least for a few months before going ahead with applying for the home loan. Even if you start before 6-7 months, and keep paying your bills regularly, you will see your credit score increase exponentially.

Hence, be a smart buyer and keep all these important points and information in mind about credit score and its huge impact on your home buying process and your dream home is guaranteed to be the part of your reality super soon.