When a property is transferred from one person to another, you must register the property in the name of the new owner at the Sub Registrar Office. Until the property finishes the whole registration charges, it will be considered to be in the incomplete stage and will not be legalised. One can’t raise any complaints about stamp duty on gift deed against their non-registered property in case of any frauds.

Without paying a rightful stamp duty charges and property registration, you will not possess the advantage to defend your property from any frauds. To secure their property, one is necessitated to register their property with the corresponding state government and follow their guidelines. To register the property, you must pay Stamp Duty Charges and registration charges.

What Is Stamp Duty and Registration?

Pay Stamp Duty Charges and registration charges to transfer the property, and you will become the legal owner only when is registered at the Sub-Registrar Office. Stamp Duty Charges are a tax levied against whatever sort of transaction that demands a certain location and is documented.

These may comprise a sale deed, conveyance deed, power of attorney, and so on. To go in-depth, it is a kind of tax that is compensated for procuring any document that promotes the origination, transfer, limits on future production, or that document any right or liability. It evolved into reality subsequently by traversing the Indian Stamp Act that was introduced back in 1899. After the stamp duty is paid, these documents convert to legal ones and have an evidence-based advantage in a court of law.

Apartments in Hyderabad starts from 15 Lakhs

Plots in Hyderabad below 5 Lakhs

Villas in Hyderabad below 80 Lakhs

What Is the Meaning of Property Registration?

Subsequently having finished the instalment of stamp duty, the archive experiences a procedure of enrollment with the assistance of the Sub-Registrar of Assurances where the property is found. This system is characterized in detail Registration as it is compulsory for all transfer of properties under Section 17 of the Indian Registration Act, 1908.

This is done so as to record the correct execution of the report with the goal that you get lawful responsibility for the recently gained property. Property registration means registering the documents of a transfer, sale, resale, Gift Deed Registration Charges In Telangana, lease, or any other form of disposal of property.

Hyderabad’s Stamp Duty and Property Registration Charges (2020)

If you are looking to purchase a new property in Hyderabad, the Telangana levy stamp duty and registration charges for the same. It is advisable to know the existing stamp duty rates and house registration charges in Hyderabad before applying for a home loan. In Hyderabad, stamp duty rates are currently paid at 4%. The Hyderabad 2020 stamp duty applies to all types of buyers, including male, female and joint proprietors.

The Registration Department of Telangana deals with different facilities, including property registration. Telangana stamp duty prices can be paid online. The online registration process for properties in Telangana is simple and hassle-free. Registration charges are also applicable to commercial properties.

List of Stamp Duty and registration charges in Telangana for sale, transfer or partition of a property.

| Stamp Duty and Registration Charges in Hyderabad - 2020 | ||

| Construction of a house/Complex with multiple apartments/Flats/Sale of any other immovable property | Stamp Duty | Registration Fee |

| At Corporations, Special Grade Municipalities | 4 % | 0.5 % |

| At Other Areas | 4 % | 0.5 % |

| Flats/Residential apartments | 4 % | 0.5 % |

Note: A 1.5 percent transfer duty is also applicable when the total stamp duty charges on the property are calculated.

One of the advantages that home buyers have in Hyderabad is that plot registration documents and apartment registration documents have been issued online by the government. This saves a lot of time for homeowners and makes the overall process rapidly. In addition, the state government has postponed its plan to increase the city's stamp duty, which is also a major relief for homebuyers planning to register their property in the short term.

How Do You Calculate Telangana Stamp Duty Rates and Registration Fees in Hyderabad?

Stamp duty and the registration fee is collected by the State Government whenever there is a property transfer.

Stamp Duty Charges count depends on the estimation of the property. Every Indian state has its very own criteria depending on which it is determined. It is commonly paid based on the circle rate that is dictated by a state government. Stamp Duty Charges additionally shifts based on the sort of property, for example, private or business, just as for urban and provincial territories.

There are three practices by which you can pay stamp obligation for the new property you are going to claim. You may consider instalment through non-legal stamp paper, e-stepping, or franking, that is you pay the obligation through some franking office or a bank that is approved to acknowledge such an instalment. Franking involves some additional charges depending on the state you are obtaining the property in.

In Hyderabad, the Telangana stamp duty rates include stamp duty, registration charge/fee plus transfer duty and is a calculated on the market value or consideration of the property, whichever is higher.

Ready Reckoner rates of Stamp Duty Charges, registration fee, and transfer duty on the sale of immovable property are available here.

Updated Information: Latest Stamp Duty Charges and Land Registration Charges 2019

| Charges for development of various properties including apartments, flats, etc as per the areas | Stamp Duty Charges | Land Registration Charges |

| Municipal/Urban | 5.0 % of Property Value | 0.5 % of Property Value |

| Rural Areas | 5.0 % of Property Value | 0.5 % of Property Value |

| Flats, Apartments (Residential) | 5.0 % of Property Value | 0.5 % of Property Value |

| At Other Areas | 4 % | 0.5 % |

| Flats/Residential apartments | 4 % | 0.5 % |

Flat Registration Charges In Hyderabad in 2018 is as follows:

Stamp duty is a state subject and is fixed by the state government. For example, in Hyderabad, the base Telangana Stamp Duty rate of apartment/ flat is 4%, transfer duty is 1.5%, and the registration fee is 0.5% of the higher of the two, market value or consideration of the property. Stamp Duty Charges is imposed distinctly on the absolute saleable estimation of the property, which is determined by first duplicating the size of the property with its direction esteem or the market worth given by the developer. At that point, vehicle parking charges and floor rise, or special area charges (PLC) are added to give the total liable estimation of the property.

Saleable Value = Basic Cost (Size of property x Guidance Value) + Parking Charges + Floor Rise Premium and Preferential Location Charges (PLC), assuming any. Enlistment charges = 1%of the saleable Value.

In this manner, the complete expense of your property would be the saleable estimation of the property in addition to stamp obligation in addition to enrollment charges.

How much stamp duty do I need to pay in case of “gift settlement deed” in Hyderabad?

- If you gift the property to relatives (approved by the Income Tax Act/ Government and Local Bodies), then Stamp Duty Charges are 1%, the transfer duty is 0.5%, and Gift Deed Registration Charges In Telangana is 0.5% (min is Rs 1000 and max is Rs 10000) of the higher of market value or consideration of the property.

- In case of any other gift, Telangana stamp duty rate is 4%, transfer duty is 1.5%, and the Gift Deed Registration Charges In Telangana is 0.5% (min is Rs 1000 and max is Rs 10000) of the higher of market value or consideration of the property.

Pay stamp duty and registration charges in case of the following transfer agreements:

Sale deed, gift deed, exchange deed, partition deed, lease deed where the period of lease is more than 12 months, transfer deed/ right transfer document, mortgage deed, and power of attorney (general or special).

Therefore, you must pay Stamp Duty Charges and Gift Deed Registration Charges In Telangana for the property even in the case of resale or gifting of property.

Procedure to pay Stamp Duty Charges and registration fee in Hyderabad

The procedure to pay Stamp Duty Charges and registration fee in Hyderabad is detailed below:

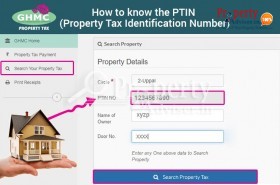

- The first step is to fill the pre-registration application form available on the “Registration and stamp department” website.

- This application form requires you to fill in “Public Data Entry” and provide details of the property that will be registered before it is presented for registration at the Sub-Registrar Office.

The reason for pre-filling the details of the property will reduce the time taken at the Sub-Registrar Office. You can submit these details online in the required format. Therefore, the applications can be processed without any delay. Also, the whole process is available here.

The Sub-Registrar Office adds the details into the system and encumbrances are created accurately.

Any of the following can be submitted as address proofs at the sub-registrar office

- Aadhaar card

- Passport issued by the Government of India

- Driver’s licence issued by the Transport Department

- PAN Card issued by the Income Tax Department

- Ration card issued by Civil Supplies Department

- Voter ID issued by Election Commission of India

- A photograph that captures the frontal view of the property (8/6 inches)

- General Power of Attorney / Special Power of Attorney, if any in original and its photocopy.

- Link documents copies.

- Webland copy in respect of agricultural properties.

- Pattadar passbooks and title deeds in original and their copies in respect of agricultural property transactions.

After verifying documents, the actual fee payment challan, and completing e-KYC, the Sub-Registrar registers the document. The step-by-step process (with screenshots) is available here.

You can follow the same procedure for registering your flat/apartment as well.

Tax Benefits of Stamp Duty Charges and Land Registration Charges:

One can easily get tax benefit past the conclusions for these two charges whenever paid inside the general limit up to Rs 1.5 Lakh. Be that as it may, there are a few conditions appended to it. These include:

• All the deductions are substantial for another property and not for resale.

• The instalments must be obligatorily made in the past budgetary year as instalments have done later are not qualified for assessment derivation. In the event that you purchased a house in 2017 for Rs 45 Lakhs and paid some amount up to 1.5 Lakhs as Stamp Duty Charges and enrollment charges, at that point you are qualified for tax cuts registered during the fiscal year 2018-2019, just if every one of the costs has been paid during 2018-19.

• Only the assessee is approved for the tax breaks on stamp obligation and other enrollment charges for a specific property, and no other relative.

• You can guarantee charge findings just for the prepared to-move-in property.

• according to Section 80C of the Income Tax Act, the most extreme utmost for a tax cut is fixed at Rs 1.5 Lakh.

• All these expense conclusions are legitimate for private property. As business property does not go under the domain of this, one can not benefit any assessment concession for that.

Browse PropertyAdviser.in, India's first-ever property directory that offers a vast range of real estate database with all the latest properties for sale in Hyderabad and trending real estate to help you choose informed decisions while choosing your dream home.

By: Shailaja K