GHMC property tax, GHMC property tax payment, GHMC property tax online payment, GHMC property tax online, pay property tax online Hyderabad.

Property Tax is a significant source of revenue for any state governments. Owner of the property is subjected to pay the property tax. It is in turn used for the maintenance of public facilities as cleanliness of the locality, construction, and maintenance of the parks, drainage facility, infrastructural developments like extension and construction of roads, flyovers, foot-over bridges, and many more.

The property tax is organized by particular municipalities of the state, where the property is located. Municipalities tend to hold smoothly and efficiently of the civic amenities to ensure the public facilities are well-maintained. Initially, property tax is administrated by the state government and later on assigned to different municipalities. So, as various municipalities differ from each other, in the same government the property tax may be levied differently for different Municipalities.

Apartments in Hyderabad starts from 15 Lakhs

Plots in Hyderabad below 5 Lakhs

Villas in Hyderabad below 80 Lakhs

What is the GHMC Property Tax?

Greater Hyderabad Municipal Corporation (GHMC) collects property tax Hyderabad on both residential and commercial properties. Property owners are liable to pay property tax. If you are the owner of a house or apartment that is located in Hyderabad, you must pay the property tax whether you live in it or rent it out to the tenants.

The municipal body that collects the tax for the properties in Hyderabad is called Greater Municipal Corporation. The landlord is liable to pay GHMC tax on a yearly basis. The amount of GHMC Tax collected is used by GHMC to repair potholes, roads, construction of parks, footpaths, plant saplings, and to improve the infrastructure of the city.

The primary purpose of this tax is to provide and maintain efficient public services to the citizens. Age, type, location of the property all are considered while levying a tax on a particular property.

Procedure to Pay GHMC Property Tax

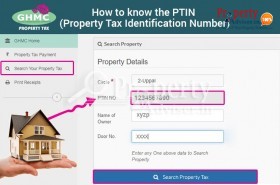

If you have a PTIN (property tax identification number), you can search on the GHMC website to find out how much property tax is due and can do through the online payment. It is a unique fourteen digit number that is allocated specifically for a particular house.

To know your property tax online, follow the procedure given below:

- Click this link to verify your property tax Hyderabad online for dues.

- Enter the PTIN.

- Click on Know Your Property Tax Dues. The search results display the payable tax details.

If you don’t have a PTIN, and you know your door number, you can use your door number to find out the PTIN.

Follow the steps given below to find your PTIN:

- Go to this link

- Choose your GHMC Circle.

- Enter your door number.

- Click Search Property Tax. The search result displays the PTIN of the property.

If you don’t know your door number, you have to submit a self-assessment request house tax online payment or offline. For the online process, you can visit the website for GHMC property tax online payment. The detailed procedure is explained later in the article.

Steps for GHMC Property Tax for New Property

If someone has purchased a new property, they need to submit the house tax Telangana application with occupancy certificate, sale deed to the relevant Deputy Commissioner. The Deputy Commissioner will further proceed for the assessment of the Hyderabad property tax. It will be later carried out by the GHMC tax inspector/Municipal Commissioner/Valuation Officer by inspection of the building.

They will also verify the legal issues like the ownership of the property, title of the property, any issues involved with property, etc. And will impose the GHMC property tax as per the present rates of the property. In case it's a residential property the prevailing rates will, in case of non-residential a fixed price.

Offline Request for Property Assessment

Submit your application to the Deputy Commissioner. The list of documents you must submit along with your application are as follows:

- Registered sale deed/gift deed/partition deed attested by a gazette officer.

- Link documents attested by a gazette officer.

- Copy of the building sanction plan.

- Occupancy certificate.

Online Request for Property Assessment

Keep Building permission, Occupancy Certificate, Sale Deed documents ready in the PDF format.

- Access the Self-Assessment Form.

- Enter your mobile number.

- Click Send OTP.

- Enter the OTP in the text box on the above page.

- The Self-Assessment Form is launched. Fill in all the details. Please note that all fields marked with a red are mandatory fields. If you don’t fill the circumstances, the form can’t be submitted.

- Browse and select the building permission, occupancy certificate, and sale deed documents in PDF formats.

- Check the declarations as applicable.

- Click Save.

After receiving the request (property tax online or offline), a tax inspector inspects the property, verifies the documents, and levies the tax. Then, the applicant gets a unique Property Tax Identification Number (PTIN) with a new house number.

Property Tax on Renovated Building

If you modify the building/ house such as extend a portion of your home or build another floor, the door number and PTIN will be the same. Only the amount of property tax GHMC will increase. To reassess the property, contact the Deputy Commissioner at the GHMC Office.

How to Calculate Property Tax for Residential and Commercial Properties?

Updating with the latest technology, GHMC has implemented a simple and easy way to calculate the GHMC tax. A resident can check GHMC property tax payment online. To pay property tax online Hyderabad, one has to log in to the website of GHMC.

As no manual process is included while doing the GHMC tax transactions, from the start of issuing the notices to collecting the receipt of GHMC property tax payment, one can do the entire process house tax online payment at their fingertips.

GHMC calculates property tax based on the area of the property, location, type of construction, and so on. GHMC website has a calculator that displays the approximate amount of GHMC property tax due if you enter the details of the property. The estimated GHMC tax may be differed by considering the correct location of the property and other parameters.

How to Calculate the Residential GHMC Property Tax?

- Calculate the plinth area of your property. The plinth area is the total built-up area which includes balconies and garage space.

- If your property is self-occupied, calculate the monthly rent per sq.ft of similar properties in your area.

- If your property is rented out, calculate the monthly rent per sq.ft as per your rental agreement.

- Use the below formula to calculate property tax. Property tax = plinth area * monthly rent per sq.ft. * % of tax (as per GHMC) - 10% depreciation + 8% library cess.

How to Calculate the Commercial Hyderabad Property Tax?

Property tax on commercial property = 30% * Annual Rental Value (ARV) of non-residential buildings.

The factors determining the Annual Rental Value of the commercial property are as follows:

- Location of the building.

- Type of construction.

- Nature of use.

- Plinth area.

- Age of the building.

Annual Rental Value (ARV) = Monthly rental value (MRV) per sq.ft. of plinth area as notified by GHMC * plinth area (in sq.ft.)

MRV is notified by GHMC and is based on zones or locality, the category of the building, type of construction, and usage.

Let’s look at an example for calculating the house tax Telangana for commercial property:

Type of construction: RCC Ordinary Building

Nature of usage: Shopping Complex

Plinth Area (in sq. ft.): 1000

Monthly Rent notified per sq.ft. of plinth area: Rs 5

Monthly Rental Value (MRV) = Rs 5 * 1000 = Rs 5,000

Annual Rental Value (ARV) = 5000 * 12 = Rs 60,000

ARV is apportioned between land and building in 50:50 ratio

Therefore, ARV of Land = Rs 30,000

ARV of Building = Rs 30,000

Age of Building = 15 years

Allowance for repairs is deducted from ARV of the building before calculating Hyderabad property tax.

Use the table below to calculate deduction allowed for repairs

|

Age of the building |

Deduction allowed |

|

25 years and below |

10% of building |

|

Above 25 years and up to 40 years |

20% of building |

|

Above 40 years |

30% of building |

Source: GHMC website.

As the shopping complex is 15 years old, the deduction allowed is 10%.

Deduction for repairs on ARV of building = 10% * 30000 = 3000

Net ARV = ARV of Building after deducting for repairs + ARV of Land

Net ARV = 27000 + 30000 = 57000

Property Tax = 30% of Net ARV = 0.3 * 57000 = RS 17,100

Add library cess @ 8% = 17100 * 0.08 = 1368

Therefore, total property tax due = 17100 + 1368 = Rs 18,468.

What are the Steps for GHMC Property Tax Online Payment?

To pay the property tax GHMC online:

- Click the link.

- Enter your PTIN in the PTI No.

- Click Know Your Property Tax Dues. The search result is displayed with the details of the property like door number, PTIN, and the amount of property tax that you must pay.

- Choose any of the GHMC property tax payment options: Debit/Credit Card or Net Banking.

- Click Submit.

Enter the details such as the 16-digit card number, the expiry date printed on the card, the CVV number, and the tax amount. - Click Pay. You will get a payment confirmation once your GHMC property tax payment is successful.

What are the Steps for GHMC Property Tax Offline Payment?

For GHMC property tax payment offline, you can visit any of the following centres:

- 72 Meeseva centres in GHMC limits.

- Citizen Service Centres in all 19 circles of GHMC.

- GHMC bill collectors have handheld machines that are integrated with the central server.

GHMC does not allow any manual transactions in property tax. The entire process of assessment, issue of special notice, issue of annual demand notice, and collection is fully computerized.

GHMC Property Tax Exemption

All lands including agricultural, commercial, residential buildings are liable to pay property tax. Based on the type of property they are segregated and taxed. But a few properties are exempted or given concessions while paying property GHMC tax.

Properties that are owned by Military servicemen or ex-employees are given a 100% exemption from paying the house tax in Telangana. Holy places like temples, mosques, churches, or any other religion are not needed to pay property tax as they are wholly exempted from it. Renowned educational institutions and residential property owners who get less than Rs. 600/- as rental income are 100% exempted from property tax.

GHMC Tax 2019 Update

As per the update, Indian union budget 2019, has given relief from property taxation to the owners. The finance minister, Piyush Goyal had proposed that property owners can enjoy the benefits of self-occupied properties up to two residences. No notional rent is needed to be paid for the second house if it is not given for lease and is vacant. According to budget 2019, a property tax exemption is given to the landlords whose annual incomes fall below Rs 5 Lakhs.

Do you love reading about the latest real estate news? Stay tuned for all updated information on real estate, properties for sale in Hyderabad, area analysis and many more.