Who Can Apply For a Joint Home Loan

Tax saving is an important annual goal of all salaried and business people. We have discussed how you can save tax by taking a home loan and investing in buying a property.

Home Loan Can be Availed Jointly

When it comes to home loans, you can take an individual home loan or a joint home loan. In the post, we will see with whom you can apply for joint home loan in India and what to keep in mind about co-applicant in joint home loan.

What is a Joint Home Loan?

In a joint home loan, two people take a single home loan for buying the same home. To explain clearly, the two people jointly apply for a home loan, on the basis of their individual incomes, and then their application may be approved. Therefore, with a home loan joint applicant, on the basis of double income, they may be able to enhance the loan amount and get a higher loan than they would if only one person had applied. They also jointly pay back the loan, and get tax benefits. First let us understand who can apply for a joint loan, or who can’t.

Joint Home Loan Eligibility

Who Cannot Apply For a Joint Home Loan

Home loan can be availed jointly. What is not possible is joint home loan with friends, colleagues and business partners. Even random relatives cannot apply for a joint home loan.

That is to say two people who are not in a close blood relation or in a marriage relation cannot apply for a joint home loan. Read on for further elaboration on joint home loan eligibility and who can apply for a joint home loan.

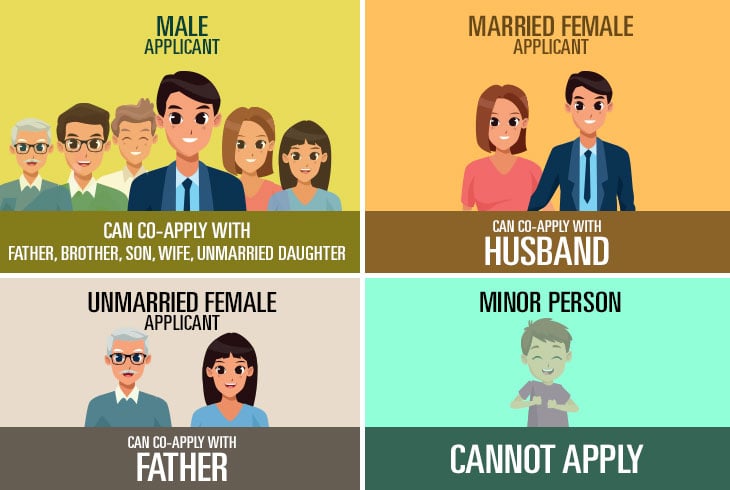

Who Can Apply For a Joint Loan

The home loan joint applicant should be members of the same family, and yet only some family members can apply for a joint home loan. You can go for home loan with father or mother. You can also go for a home loan with your wife or husband. Home loan with sister is not usually possible.

See below for a better understanding about joint home loan with parents and other family members.

Consider Inheritance Disputes & Legal Complications

In case of joint home loans, take care to sort the ownership in a way that will help you avoid inheritance disputes and legal complications.

For example, if a father and son are taking a joint home loan, and the latter is the only son, then they can be joint owners of the property. But if the father has other sons too, then the son should be the main owner of the property. If the father is the main owner of the property, then other sons who are also his legal heirs may cause inheritance disputes.

Similarly, if an unmarried daughter is applying for a joint loan with mother or father, then the property should be owned by the daughter to avoid legal issues after she gets married.

Main Applicant & Co-applicant

The owner of the property is the main applicant, and the said owner’s spouse, mother, father, or brother - as the case may be - can be co-applicant in joint home loan.

Whose Income Will the Bank Consider For Approving the Loan?

If a father and son, or husband and wife are applying for a joint home loan, then both their incomes may be considered by banks for calculating loan eligibility.

If a daughter is applying for loan with father or mother, then the parent’s income may not be considered by banks for computing loan eligibility.

Responsibilities of Co-applicant in housing loan

The co-applicant in a housing loan will be responsible for repayment of joint home loan in case the partner defaults payment, or refuses to make the payment, or dies during the repayment period.

Go ahead and apply for a joint home loan to enhance loan eligibility and avail taxation benefits.