Important points to know for NRI to buy a house in India

Who is an NRI?

A Non-Resident Indian (NRI) is an Indian citizen (has an Indian passport) has immigrated to another country to reside, work, study, do business, or for any other purpose. Also, if any person stays in India for less than 182 days in a year, he becomes a non-resident in India.

Person of Indian Origin (PIO): A PIO is a person if his parents or grandparents were citizens of India as per the Indian Constitution or the Citizenship Act, 1955. He may have been an Indian citizen in the past and is a citizen of a foreign country now.

OCI is a foreign national who was eligible to become a citizen of India as on 26 January 1950. Or, he belonged to a territory that became part of India as on 15 August 1947. Even his descendants, including children and grandchildren, can register as an OCI.

Why Are These Classifications Important?

In the real estate context, a person living overseas or an NRI buying property in India. The Reserve Bank of India governs the property transactions by an NRI/PIO/OCI, and you must comply with the provisions given in the Foreign Exchange Management Act (FEMA), 1999.

Is NRI Valid in India to Buy a Property?

For an NRI buying property in India, be it any residential or commercial property has to follow a straightforward process once you have all your funds sorted out. But if you are looking to purchase agricultural land, plantation property or a farmhouse in India, it’s essential to get appropriate permission from the RBI and the particular state government for an NRI to be valid in India.

What Is the Procedure for a PIO/ OCI/NRI Buying Property in India?

If you are an NRI/PIO/OCI, you must meet the following conditions before buying property in India:

-

Can only purchase immovable residential or commercial property in India.

-

Cannot buy agricultural land, plantation property, or a farmhouse in India.

-

Cannot get agricultural land, plantation property, or a farmhouse in India as gifts.

-

As an exception, you can inherit agricultural land, plantation property or a farmhouse.

However, an NRI/PIO/OCI can inherit residential or commercial properties from a resident of India as per the provisions of the FEMA.

And, an NRI/PIO/OCI can get a residential/commercial property as a gift from a resident of India or another NRI/PIO/OCI.

Point of Attorney For an NRI

For an NRI buying property in India, who is not present in India while purchasing the property, they can opt Power of Attorney(POA) by following the procedure for NRI to buy property in India. In this context, it indicates that an NRI can select their trusted acquaintance, a friend or a close relative to complete the transactional procedure for signing the essential documents on your behalf. To get approval for POA, For NRI buying property in India are first needed to visit the Indian Embassy and carry the procedure of POA with the required documents and photos, NRIs left thumb impression, signature in front of the consulate officer. After the completion of the entire process, it further sent to India.

Do I need to seek RBI approval to buy property in India?

For an NRI buying property in India, you don’t need to get RBI approvals to buy the immovable property if it is for residential or commercial use.

How many properties can an NRI buy?

RBI has not prescribed any limit on the number of residential properties an NRI can buy in India.

For an NRI buying property in India buying jointly with another Indian citizen. Although he cannot buy it together with a foreign citizen.

What Are the Tax Implications?

What are the instances in which I will be taxed in India?

You will be taxed if you either earn rental income or sell the property and if the income earned is above the exemption limit for individuals as per the Income Tax Act.

If you an NRI/PIO/OCI and want to buy an immovable property, you don’t have to pay any income tax.

However, if you are selling a property in India, you must pay tax on the short-term capital gain or the long-term capital gain.

To assess and pay tax, you must file income tax returns. Also, you file income tax returns if you want to claim a refund for excess taxes paid.

What If an NRI Earn a Rental Income from the Immovable Property?

If you earn rental income on your house/ building, you must pay income tax it as well. You can claim deductions such as standard deductions, municipal taxes paid, and interest and principal repayment on home loan as per the Income Tax Act.

What Are Capital Gains and How Is It Taxed?

For an NRI buying property in India, calculate the short-term capital gain if you buy an immovable property and sell it before 36 months. It is the difference between the selling price and cost price.

Alternately, calculate the long-term capital gain if you buy an immovable property and sell it after 36 months. It is twenty per cent (20%) of the difference between the selling price and the indexed cost price.

Add short-term or long-term capital gain to your taxable income in India and pay tax on your current income slab.

For an NRI buying property in India, you can claim the deduction if you have invested the amount in tax-deductible savings schemes. The other deductions such as the amount paid to tax-deductible charities and repayment of principal and interest on the home loan.

When do an NRI File income tax return in India?

If your taxable income is more than the exemption limit for individuals, you file your income tax return in India.

Is an NRI Allowed to Borrow Money from the Bank as a Home Loan for the Purchase of Immovable Property in India?

For suppose for an NRI buying property in India who doesn’t have the required funds can get a home loan. As per the new rules, the RBI has allowed permission to banks and financial institutions that are enrolled with the National Housing Bank to provide home loans for an NRI buying property in India. All the financial transactions have to be executed in Indian currency. After the completion of the procedure, the home loan cannot be credited directly to the bank account of an NRI. It will be with either the seller’s or the builder's bank account directly. For an NRI buying property in India, the loan can further be compensated using funds in an NRI’s NRO(Non-Residential Ordinary) account or FCNR (Fixed Deposit Foreign Currency account) deposits. If an NRI is getting a part or full payment without a home loan, then they can do so by dispatching the money through sanctioned banking channels from overseas. They can also use money in their NRO accounts. Traveller’s cheques or foreign currency is not considered as an agreeable means of payment.

As an NRI/PIO/OCI, you can take a home loan in India to purchase an immovable property or for repairing and renovating your house.

An NRI/PIO will be eligible to take a home loan if he meets the following criteria:

-

For an NRI buying property in India, the borrower must have a valid Indian passport or a PIO with a valid foreign passport can apply.

-

He must be aged more than 18 but less 60.

-

Maximum loan tenure is for 30 years.

Eligibility criteria to apply for SBI bank NRI loans are as follows:

In addition to the above criteria, SBI bank provides NRI loans to the following people:

-

For an NRI buying property in India, he/she must have a total work experience of 2 years in India or abroad.

-

NRIs holding a valid job contract/work permit for two years can apply after they complete six months working on the current job.

-

Any Indian citizen who works abroad on assignments with International Agencies such as the United Nations Organisation (UN), International Monetary Fund(IMF), World Bank, Merchant Navy, and so on.

-

Any central or state government official who is deputed abroad on temporary assignment elsewhere.

Documents Required for NRI to Buy Property in India with a Loan:

-

Identity card issued by the employer.

-

Attested copy of valid passport and visa of NRI.

-

PIO card issued by Government of India (for PIOs).

-

Copy of continuous discharge certificate for applicants who work in merchant navy.

-

Proof of current overseas address.

-

Completed loan application form with three passport size photographs.

-

Identity proof (copy of any one of these): PAN/Passport/Driver’s license/Voter ID card.

-

Residence Proof (copy of any one of these): telephone or electricity or water bill/piped gas bill/copy of passport/driver’s license or Aadhar Card.

The other documents required for NRI to Buy Property in India:

Income proof

If the applicant is a salaried person:

-

A valid work permit and employment contract documents as are necessary for NRI to buy property in India

-

Submit payslips of the previous three months.

-

Bank statement showing salary credited for the last six months.

-

Original salary slip of the last month and a copy of identity card issued by the employer.

-

Acknowledged copy of the previous year’s income tax return (except NRI/PIO from Middle East countries or employees of Merchant Navy).

If the applicant is a professional or businessmen:

-

Proof of address of the business documents are required for NRI to buy Property in India

-

Proof of business income.

-

Audited balance sheet and profit and loss account of the previous two years.

-

Copies of the Income-tax returns filed during the previous two years (except NRI/PIO from Middle East countries).

-

Overseas Bank account statement of both the company and the applicant for the last six months.

Bank statement of the applicant:

As documents required for NRI to buy Property in India, they need to submit the previous six months bank account statement of both Indian and overseas account

Loan account statement for the last one year in case of any other loan.

For an NRI buying property in India, the bank also needs property documents required for NRI to buy Property in India such as construction permits, a copy of approved plans, registered development agreement of the builder, conveyance deed for the new property, occupancy certificate for ready to move property, and bank account statement showing payments made to the builder.

Mode of repayment (regulated by RBI)

You can repay the loan in any of the following ways:

-

Transfer money to the bank via direct remittances from abroad through net banking.

-

Issue post-dated cheques for payments through NRO, NRE, NRNR, or FCNR account.

You must repay the loan within a maximum period of 30 years.

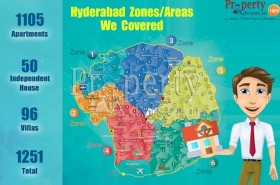

Are you interested in uncovering more such real estate articles? Browse PropertyAdviser.in, India’s first ever property directory to know about all latest properties for sale in Hyderabad with accurate information.

By: LOTUS TECH & Govi